About Us

Our Story

1st Class Credit Union, formed in 1992, was originally set up to serve employees of The Royal Mail Group in Glasgow. We are a not-for-profit financial co-operative, owned and run by our members. We have a volunteer Board of Directors who offer their time to improve the services of our Credit Union.

Over the years, we have broadened our membership to include employees and retirees from the following sectors and organisations across the UK and Northern Ireland:

- Royal Mail Group

- Communications Industry

- Public and Commercial Services Industry

- Members and retired members of the Communications Workers Union (CWU)

- Members and retired members of the Public and Commercial Services Union (PCS)

- Members or retired members of the UNISON

- Members or retired members of the Unite the Union

- Members or retired members of the Professional Footballers Association (PFA)

- Members or retired members of the Professional Footballers Association Scotland (PFAS)

Additionally, we offer Family and Junior Memberships to members’ families who reside at the same address.

Not sure if you qualify?

If you’re unsure whether you fall within our Common Bond, give us a call at 0141 552 8408 and our team will be happy to assist.

Why Join Us?

As a member of our Credit Union, you’ll enjoy the peace of mind that comes with saving your money in a safe, secure environment. Your savings are protected by the Financial Services Compensation Scheme, and your account includes free life insurance (terms and conditions apply).

We also offer affordable loans to help you avoid costly payday lenders with high interest rates. With us, you can build your savings and access low-cost borrowing options that work for you.

As a member of 1st Class Credit Union, you gain exclusive access to our 1st Class Discount Club, offering an incredible range of money-saving benefits. Enjoy discounts across categories like health and fitness, home and car essentials, food and drink, fashion, tech, and entertainment!

Join today and take the first step toward financial stability and peace of mind!

Our Common Bond

To join 1st Class Credit Union you need to meet at least one of the following criteria. Please read through and confirm that you are eligible before applying to join

- I am an employee of the Royal Mail Group

- I am an employee in the Communications Industry

- I am an employee in the Public and Commercial Services Industry

- I am a member or retired member of the Communication Workers Union (CWU)

- I am a member or retired member of the Public and Commercial Services Union (PCS)

- I am a member or retired member of UNISON

- I am a member or retired member of Unite the Union

- I am a member or retired member of the Professional Footballers Association (PFA)

- I am a member or retired member of the Professional Footballers Association Scotland (PFAS)

- I am a family relation to a current member of 1st Class Credit Union

Become a Member

Joining the Credit Union is the best decision you could take for your money. Our Credit Union lets people in the community come together to save and borrow money at low rates, and is operated on a not-for-profit basis.

Become a member today!

Join Us- Credit unions help you save regularly, borrow responsibly, and keep on top of your finances.

- Credit unions have partnerships with many employers allowing staff to save and repay loans directly from payroll.

- Credit unions offer affordable loans, ranging from short-term loans of a few hundred pounds to much larger loans for holidays, buying a car, or home improvements among other things.

- Credit unions offer competitive rates on loans of all sizes. For smaller-sum loans, interest on credit union loans is always much lower than that charged by doorstep or payday lenders.

- Credit unions make it easy to save – even a small amount saved each week will soon mount up.

- Credit unions are co-operatives, meaning that any profits are shared with their members. This often means savers will receive a dividend on their savings every year, which could be as much as 3%.

- Credit unions can offer credit to people whose circumstances might mean they struggle to get a loan from other lenders.

- Credit unions ensure that all money saved is protected by the Financial Services Compensation Scheme (FSCS) up to the value of £120,000 per person – the same level of protection as savings in a bank or building society.

Being a member of our credit union comes with a host of benefits, such as:

- Access to loans up to £20,000

- Account covered by the Financial Services Compensation Scheme

- Annual Dividend paid on savings (subject to surplus)

- The right to vote on decisions that affect your Credit Union at our AGM

- Joining more than 10,000 members who are currently helping one and other

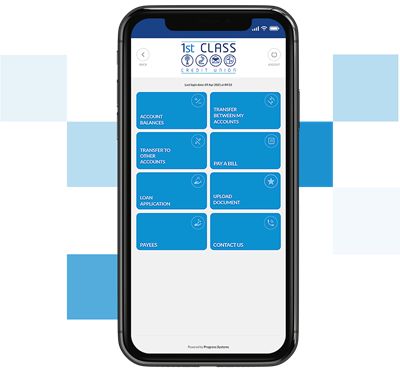

- Access to your account 24/7 online and through our Mobile App

- Save specifically for Christmas with our Christmas Club Account

- Save £££s with our 1st Class Discount Club - Find out more.

As a credit union, we are committed to offering products and services that help members manage their money and build up a history of good money management. At 1st Class Credit Union, we have created a culture of saving regularly and lending responsibly while promoting good money management.

- We aim to provide the best level of service we possibly can.

- We will lend responsibly and provide products that suit your needs and that you can afford.

- We will treat you as an individual and ensure that your circumstances are considered.

- We will provide information about our products and services in a clear and understandable way, so you can decide what is best for you.

- We will always aim to assist you if you find yourself in financial difficulty and find a solution that helps you to find a way to repay your loan.

Your commitment to us, we ask;

- You always ensure that you can afford to repay your loan by reading all the information and asking questions.

- You pledge to save the minimum weekly or monthly amount whilst repaying your loan.

- You make your loan repayments on time, using a payment method agreed upon when you sign your loan agreement or an alternative method if necessary.

- You tell us as soon as possible if you find you are struggling to repay your loan or are experiencing financial difficulty.

- You will ensure that you tell us of any change of contact details or change of circumstances.